Key Takeaways

Master the core compliance rules (rates, registration, deadlines).

Employers must follow the 10 rules — most critically: register every new employee with KWSP from day one, apply the correct contribution rates (employer: 13% for ≤RM5,000 and 12% for >RM5,000; employee: 11%), and submit payments by the 15th of each month. These are non-negotiable legal requirements.

Calculate contributions precisely and be transparent to employees.

Use KWSP’s official tables and include the right salary items (basic, allowances, overtime, commissions, bonuses) while excluding reimbursements and travel allowances. Deduct the 11% employee share before pay and show the breakdown clearly on payslips to maintain trust and avoid disputes.

Automate, keep records, and consider outsourcing to avoid costly mistakes.

Pay online (KWSP i-Akaun, FPX, payroll integrations), keep detailed monthly payroll and KWSP-matching records, and act fast on arrears — late payments attract dividend charges, fines (up to RM10,000) and legal risk. Many employers reduce risk and save time by outsourcing payroll/HR to specialists like MUSTRE.

In today’s fast-moving business landscape, understanding Malaysia EPF contribution requirements isn’t just a legal checkbox.

It’s a core component of building a trustworthy, well-managed company.

Upskill Staf Anda: Bina Website Mesra SEO

Bengkel praktikal 2 hari untuk bina laman web syarikat yang kemas, pantas, dan mudah diurus.

Domain + Hosting + Elementor Pro PERCUMA 1 tahun

Whether you’re running an SME, startup, or scaling enterprise, EPF (Employees Provident Fund) contributions affect employee morale, financial security, and your credibility as an employer.

The more informed you are, the fewer risks you face—from penalties to employee dissatisfaction.

Let’s explore the 10 essential rules all employers in Malaysia need to follow—plus how outsourcing to professionals like MUSTRE can make HR compliance much easier.

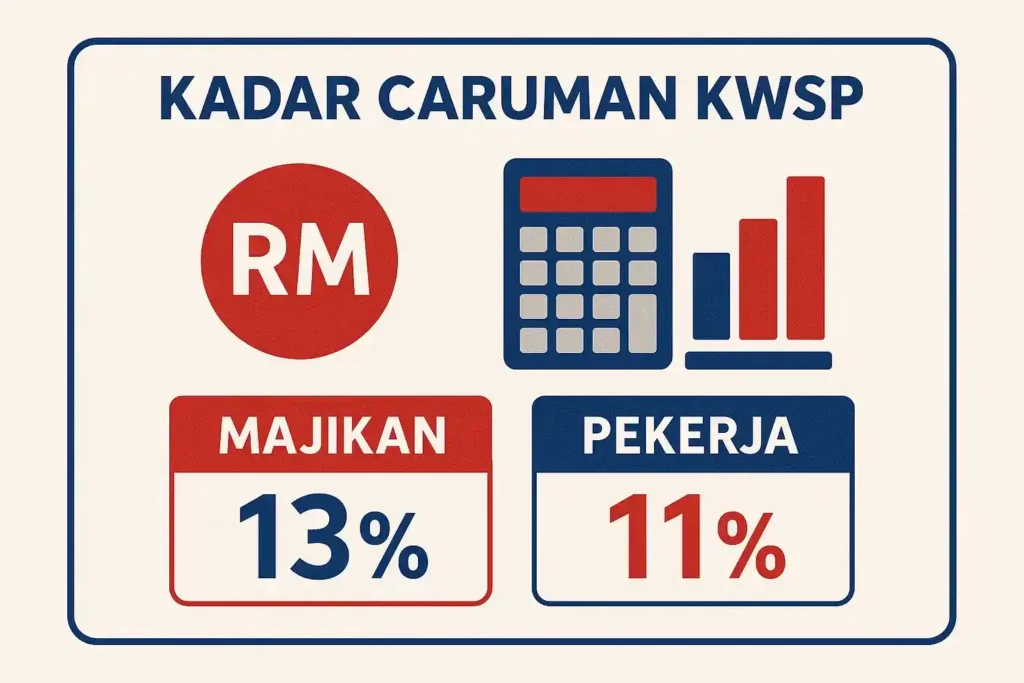

1. Know the Legal epf company contribution Rates

As of 2024, the employer’s Malaysia EPF contribution rate is:

- 13% for employees earning RM5,000 and below

- 12% for employees earning above RM5,000

Employees must contribute 11% regardless of income level. These rates apply strictly to citizens and permanent residents—with no exceptions.

2. Registration Is Mandatory From Day One for epf contribution Malaysia.

You must register your business and each new employee with KWSP immediately upon hiring. This isn’t optional—it’s a legal obligation under the EPF Act 1991.

3. The Deadline Isn’t Flexible

EPF payments must be submitted by the 15th of each month. Late payments invite penalties, dividend charges, and even potential legal prosecution.

4. Salary-Based Calculations Require Precision

Use KWSP’s official contribution table to calculate the exact employer and employee portions. Factors include:

- Employee’s salary

- Age

- Residency status

Foreign workers who are non-residents typically aren’t required to contribute, but there are exceptions for permanent residents.

5. Understand What’s “Contributable”

Included in EPF calculations:

- Basic salary

- Allowances

- Overtime

- Commissions

- Bonuses

Excluded:

- Reimbursements

- Travel allowances

- Retirement gratuities

6. Pay Online to Stay Efficient

Most employers use:

- KWSP i-Akaun (Employer)

- FPX online banking

- Payroll software integrations (SQL, Kakitangan, HReasily)

Automation ensures accuracy and saves hours of manual processing.

7. Employee Contributions Must Be Deducted Properly

The 11% employee contribution must be deducted before salary disbursement and clearly stated on the payslip. Transparency is key for employee trust.

8. Late or Missed Payments Have Serious Consequences

Penalties for non-compliance include:

- Dividend charges on overdue amounts

- Fines up to RM10,000

- Risk of audit and legal action

9. Maintain Detailed Payroll Records

Accurate EPF reporting means:

- Monthly payroll summaries

- Up-to-date employee records

- Matching your reports with KWSP receipts

This is where HR outsourcing to MUSTRE becomes invaluable.

10. Voluntary epf malaysia contribution: When and Why?

Employers and employees can opt for:

- Contributions above minimum rates

- Reduced rates during special periods approved by the government

- Third-party top-ups (e.g., from Tabung Haji or others)

Understanding these options empowers better planning.

Common Mistakes Employers Make

Many Malaysian companies stumble due to:

- Misreading contribution brackets

- Missing deadlines

- Confusion over what salary items to include

The solution? Automate your systems or outsource HR to experts like MUSTRE to ensure everything stays aligned with the Employment Act 1955.

Best Practices for EPF Compliance

- Cross-check KWSP tables monthly

- Train payroll staff thoroughly

- Use digital tools for payslip breakdown and reporting

- Outsource HR and payroll for peace of mind

Why It All Matters

Mastering Malaysia EPF contribution rules protects your business from fines, builds employee trust, and strengthens internal HR processes.

It’s not just about compliance—it’s about leadership.

Ready to Simplify EPF & HR?

If managing EPF feels complex or time-consuming, you’re not alone.

That’s why companies across Malaysia are turning to MUSTRE—a trusted HR outsourcing firm that understands your local compliance needs and speaks your language.

👉 Contact us today for a free consultation and discover how we help SMEs save time, reduce errors, and stay 100% compliant with Malaysia’s employment laws.

FAQ

Q1 — What are the malaysia epf contribution rates for employers and employees?

A1 — As stated in the blog: employer contributions are 13% for employees earning RM5,000 and below, 12% for employees earning above RM5,000; employees contribute 11% regardless of income. These rates apply to Malaysian citizens and permanent residents.

Q2 — When must I register and pay EPF for a new hire?

A2 — Register your company and the new employee with KWSP immediately upon hiring, and submit monthly contributions by the 15th. Registration from day one and on-time payments are legal obligations.

Q3 — Which salary items are contributable to EPF and which aren’t?

A3 — Include basic salary, allowances, overtime, commissions and bonuses in EPF calculations. Exclude reimbursements, travel allowances and retirement gratuities. Use KWSP’s official table to confirm specifics for edge cases.

Q4 — What happens if I miss or pay EPF late — and how can outsourcing help?

A4 — Late or missed payments can attract dividend charges on overdue amounts, fines (up to RM10,000), audits and legal action. Outsourcing payroll/HR to a specialist (the blog cites MUSTRE) helps automate calculations, ensure on-time online payments, maintain records, and reduce the risk of costly penalties.

Q5 — Can employers make voluntary or additional malaysia epf contribution beyond the minimum?

A5 — Yes. Employers and employees may opt for voluntary contributions above the statutory minimum, apply reduced rates during special periods approved by the government, or allow third-party top-ups (such as from Tabung Haji). Understanding these options helps employers plan better benefits while staying compliant.